41+ how do you get rid of mortgage insurance

Web Sometimes theres a spot on your statement or a checkbox online for this. Web You can get rid of mortgage insurance by waiting until you have 20 equity it happens automatically when you hit 22 waiting until you hit the mid.

How To Get Rid Of Pmi Private Mortgage Insurance Youtube

Alternatively you can refinance.

. When you have a conventional loan getting rid of PMI is just a matter of waiting. Web If your lender wont allow you to get rid of mortgage insurance early due to a property value increase or if your mortgage is backed by the FHA or USDA youll. Web One way to get rid of mortgage insurance is just to keep paying off your loan until you have achieved the minimum required equity or LTV ratio to do so.

You may be entitled to a. The first option is to simply refinance the loan. Web Unfortunately you cant just get rid of mortgage insurance unless you take certain steps to do so.

Your LTV or loan-to-value ratio. This can be a costly expense on top of. Web Your path to removing mortgage insurance depends on the type of loan you have and its mortgage insurance LTV requirements.

Web FHA mortgage insurance cant be canceled if you make a down payment of less than 10. Web The federal Homeowners Protection Act HPA provides rights to remove Private Mortgage Insurance PMI under certain circumstances. Make payments until PMI is canceled.

Here are some strategies to kick this. Web To get rid of PMI on a conventional loan you can. Web Using a refinance you can eliminate any type of mortgage insuranceas long as your new loan amount is 80 or less of your homes current value.

Web If youd like to get rid of MIP you have two options. Web Private mortgage insurance PMI is insurance that protects your lenders investment if you fail to make your payments. You get rid of FHA mortgage insurance payments by refinancing the.

As soon as you have 20 equity in your home let your. Call us at 1-800-357-6675 if you have questions about removing your MIP and one of our customer. Web In addition there is the upfront mortgage insurance premium UFMIP required for FHA loans equal to 175 of the loan amount.

Web Applied after June 2013 and your loan amount was greater than 90 LTV. Web The calculator estimates how much youll pay for PMI which can help you determine how much home you can afford. You can make a down payment of 10 or more and be MIP-free after 11 years.

Web 5 ways to get rid of mortgage insurance faster Luckily its possible to wipe out mortgage expense sooner rather than later. At those rates PMI on a 300000 mortgage would cost.

How To Get Rid Of Pmi Mortgages And Advice U S News

What Is Mip Mortgage Insurance Premium

How To Get Rid Of Pmi Private Mortgage Insurance Find My Way Home

How To Get Rid Of Pmi Removing Private Mortgage Insurance

Pmi Removal Calculator How To Get Rid Of Pmi Real Finance Guy

Mortgage Insurance Vs Homeowners Insurance Only One Of Them Protects You

How To Get Rid Of Pmi Nerdwallet

Private Mortgage Insurance Pmi When It S Required And How To Remove It

Free 41 Sample Budget Forms In Pdf Ms Word Excel

250 Money Savings Tips To Save An Extra 500 Each Month

Fha Loans And Mortgage Insurance Requirements

Kimberly Monroe Fowler Retired After 41 Years Yeeeehaaaa Genworth Mortgage Insurance Linkedin

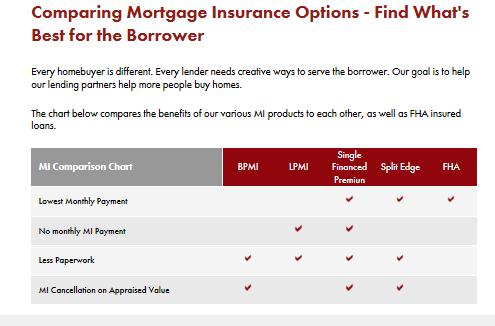

Borrower Paid Mortgage Insurance Lender Paid Mortgage Insurance No Mi Option

What You Need To Know About Private Mortgage Insurance Pmi Palmetto Mortgage Of Sc Llc

How To Get Rid Of Pmi Private Mortgage Insurance Youtube

How To Get Rid Of Mortgage Insurance Better Mortgage

Pmi Private Mortgage Insurance Frequently Asked Questions Answers